So if you want to convert an ira to a roth ira for 2018 and have that income included for 2018 the conversion must take place by december 31 2018.

Are backdoor roth conversions allowed in 2018.

A method that taxpayers can use to place retirement savings in a roth ira even if their income is higher than the maximum the irs allows for regular roth ira contributions.

Is this situation any different tax wise had i done the conversion before 12 31 for each year p.

Deadline for a roth conversion 2018.

Therefore you shouldn t ask your ira custodian or trustee for a backdoor roth ira contribution.

You can do a roth conversion up until dec.

More the complete guide to the roth ira.

Claim 11k roth conversion in my 2019 taxes.

The backdoor roth ira contribution is a strategy and not a product or a type of ira contribution.

I have 0 funds in my ira right now.

However you might not know your full tax.

They re complicated but still legal.

Can i now contribute 11000 to my ira 2018 and 2019 combined and convert all of them to roth immediately.

A do over meant that you could do conversion and then undo the transaction up until oct.

I ve got my 2 acres of non leveraged crop producing cashflowing farmland via acretrader.

Backdoor roth ira conversions.

See irs sets final 2018 deadline for roth conversion.

For 2018 the ability to contribute to a roth ira begins to phase out for singles with a modified adjusted gross income of.

In 2018 congress officially blessed the steps of the backdoor roth as allowed under current law.

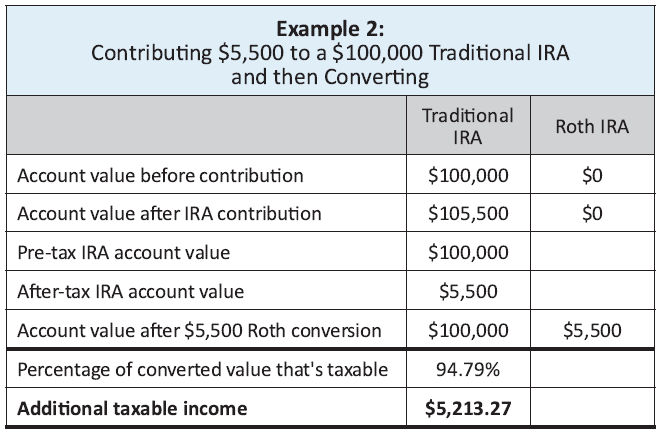

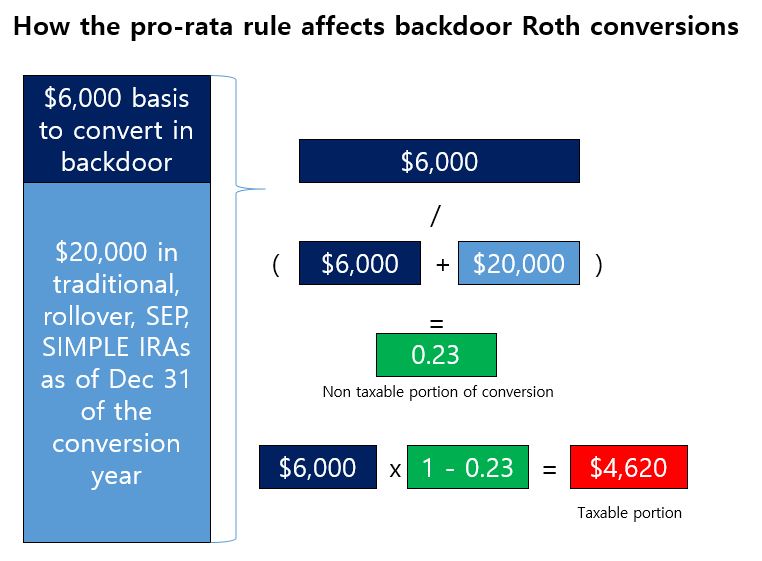

A backdoor roth ira allows taxpayers to contribute to a roth ira even if their income is higher than the irs approved amount for such contributions.

15th in the following year if you decided that you wanted to avoid the tax hit.

It used to be that you could do over your roth ira conversions.

See forum thread and links in the white coat investor forum.